Anchoring on Resiliency: Our Investment in Elemental Machines

By Jeff Klemens, Caitlin Vorlicek, and Henry Vogel

The Sageview team is thrilled to announce our investment in Elemental Machines, a leading provider of data collection, reporting, and analytics for labs in the life sciences market. Within the context of an uncertain economic and investing environment, we wanted to take a deep-dive into the unique combination of attributes that allowed us to gain conviction in our investment in Elemental Machines: its mission-critical, high-ROI product with limited direct competition serving a resilient, high-growth end market.

Why we are Excited

Located in Cambridge, MA, the hub of life sciences innovation, Elemental Machine’s core product provides lab managers with the tools they need to avoid costly mistakes and report on crucial compliance metrics in real-time. Elemental Machines helps lab managers avoid losing valuable inventory due to operational oversight. It also ensures compliance by enabling integrations with electronic lab notebooks, so scientists can track ambient data within their experiments, potentially flagging issues like false positives due to environmental disturbances. The combination of cost-savings and compliance automation makes Elemental Machines a must-have solution in the lab manager toolkit. Upon meeting the team, our first impression of the company was that its founder Sridhar Iyengar was laser focused on product. After digging into the data, we found that this focus proved invaluable. Quarter after quarter, Elemental Machines showed an impressive combination of best-in-class gross and net retention, strong LTV/CAC, and high win rates. This type of performance often indicates that a product delivers strong and measurable ROI; this was supported by our many conversations with the broader market.

Interestingly, despite the mission-critical nature of Elemental Machines’ product and the exponential growth of life sciences (more on that below), we found that the LabOps market suffered from a lack of modern, cloud-based innovation. When Elemental Machines acquired its major competitor (a division of TetraScience) in 2021, the combination led to a unique product that was clearly resonating with lab managers regardless of the type of research conducted, phase of product, or scientific outcome.

Taking a Step Back: A Brief History of Life Sciences & Biotechnology

The advent of COVID-19 brought international attention to the importance life of sciences; however, the reality is that life sciences has been a resilient growth sector for decades. Dating back to the Drug Orphan Act of 1983, public and private sectors have fueled the advancement of life sciences and its consistent habit of bucking broader macroeconomic trends. This advancement has been largely driven by the growth of biotechnology, which took off in the 1980s when novel biotech innovation led to the treatment of major debilitating diseases such as diabetes. Progress accelerated in the 1990s when the number of biotech molecules studied quadrupled, R&D spending grew from $4bn+ to $14bn, and biotech companies increased from a few hundred to more than 4,000. By the 2000s, biotech was well-established, and the pharmaceutical sector began consolidating the space to strengthen its own pace of innovation. In the most recent decade, many of the top biotech products came off patent, and the development of “biosimilar” products aided continued growth.

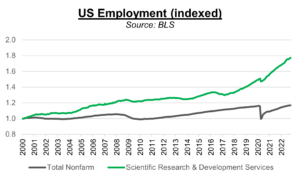

The sector has demonstrated resiliency through each of these periods. The Great Recession (2007-2009) resulted in financial challenges for some biotech companies. However, overall life science employment grew by over 6% in the first decade of the 2000s despite overall economic shrinkage. Venture funding has also continued to balloon, reaching a record $77 billion in 2021 as the COVID-19 pandemic heightened awareness of the societal importance of life sciences innovation even more. Looking forward, Biotech’s multi-year drug pipelines facilitate relatively predictable investment underwriting, and we believe there is little to impede the continued growth of the sector for years to come, regardless of macroeconomic volatility. Ultimately, this benefits Elemental Machines given the Company’s growth opportunity is directly tied to lab equipment and space.

Our Partnership with Elemental Machines

This combination of resilient end market and high-ROI product (that avoids taking on scientific risk) ultimately provided an investment opportunity to index on the growth of life sciences broadly while delivering compelling value to the industry. The last piece of the puzzle came together when Sridhar and his team sought a hands-on partner to help the business scale post-product-market fit and execute against its best-in-class unit economics. We are eager to get to work, helping to build the team, infrastructure, and processes that will enable Elemental Machines to realize its full potential in life sciences and beyond.

Sources…

https://www.healthaffairs.org/doi/10.1377/hlthaff.2014.1023

https://www.massbioed.org/a-glance-at-the-growth-of-the-life-sciences-over-the-past-20-years/