Breaking Ground on Increased Technology Adoption in Construction

By Roberto Avila & Will Kunin

We at Sageview love vertically focused software and tech-enabled companies and have backed many of these businesses through their growth journeys (Reflexis, Theatro, Elemental Machines, etc.). We have helped our vertical-focused software companies (and many portfolio companies): 1) Build and scale sales teams, 2) Recruit new team members, 3) Evaluate M&A, and 4) Expand into adjacent markets.

Over the years, we’ve seen that different verticals have been faster to adopt software and digitization (IT, Media, Professional Services, and Finance), while others have been more hesitant (Construction and Agriculture). With this dynamic at play, we believe there is clear value for vertical-focused software that supports the specific needs of these historically ‘slower to adopt’ industries. The time is now for construction tech to shine.

Construction Tech Adoption Has Historically Lagged

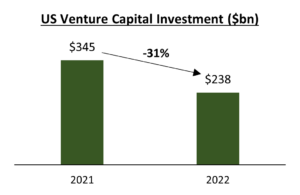

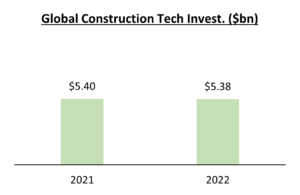

The construction industry has had vertical-specific software for decades from vendors like Procore, Autodesk, Trimble, and HCCS. There are also many emerging construction tech vendors that, in aggregate, received $5.4 billion in investment in 20221 (approximately the same amount relative to 2021) amid a challenging venture funding environment that saw a -31% pullback in funding year-over-year2. Despite the prevalence of existing and emerging construction tech vendors, the adoption of technology in the construction industry remains relatively low.

Note: Over 80% of Construction Tech investment in NA and Europe

Why The Delay?

A construction project involves numerous stakeholders (owners, general contractors, engineers, insurers, subcontractors, architects, project employees, equipment suppliers, regulators, and others), each with different responsibilities, incentives, and risk profiles. General contractors are responsible for planning and implementing all activities contributing to project completion. Even though they oversee the entire project, general contractors do not prioritize IT. A 2021 Construction Technology survey from JBKnowledge highlights that only 44% of contractors have a dedicated IT department. Further, 75% of contractors surveyed spend 2% or less of sales on IT (33% of contractors spend less than 1%). This is well below the cross-industry IT spending average of 3.5%. What are some reasons for low adoption and lack of prioritization?

- Low Profit Margins: Contractors have thin profit margins of ~6%3, and technology investments have been perceived to eat into these margins. Are general contractors not investing in IT because of low margins, or is the lack of IT investment contributing to low margins? Regardless, technology vendors have yet to demonstrate clear ROI consistently. Contractors have also seen their margins impacted by significant material inflation, with construction material prices up 25% in 20214. Increased input costs are forcing contractors to find efficiencies in other areas of their business and technology can immediately help.

- Each Project is Unique: Almost every construction project differs from the last. Two identical office buildings at two different sites will face unique challenges. Each project’s “one-off” nature makes it challenging to adopt uniform technology solutions.

- Stakeholders are Fragmented: The traditional construction delivery method of design-bid-build involves multiple participants, each following their own processes. Each stakeholder may have differing levels of digital maturity, and their work on the project is temporary. A major stadium project could have +50 parties doing different things on a job.

Breaking Ground

Despite limited penetration, an initial wave of construction technology adoption and evangelization has been driven by the first movers in the space. Construction stakeholders have been educated on technology, exposed to marketing, and have implemented software into their workflows. Initial technology experiences and feedback present an opportunity for second/third movers to grow market share. Conversations with construction technology vendors and general contractors have identified a few immediately addressable opportunities.

- Increased Importance of Collaboration: Increased collaboration across project stakeholders is more important than ever. The complexity and fragmentation of construction projects necessitate collaboration to drive efficiencies and reduce rework (rework is often 5% of the contract value of each project5). Everyone on a job site has data needs, but data and models are not always accessible to all stakeholders. Additionally, more projects are moving toward Construction Manager at Risk (where construction managers must meet their guaranteed maximum price or pay the difference), which requires collaboration.

- Moving Beyond Data Creation to Synthesis & Insights: In the past decade, construction stakeholders are creating/accessing more data than ever. This data now comes from drones, 360-degree cameras, sensors, wearables, and project management platforms. If less than half of general contractors have an IT department, what are they doing with this data? Solutions that make data actionable and help stakeholders derive near-term value from data will become increasingly important.

- Continued Focus on Safety and Compliance: Jobsite safety has always been a top priority, and contractors are shifting towards more proactive safety management. Technology that increases workforce visibility ensures ongoing training, and takes advantage of predictive analytics can help construction companies stay on their front foot, improve worker safety, and increase efficiency.

Keys to Technology Adoption

High ROI solutions with short time to value will see the most adoption. Construction stakeholders live project to project and thus have a shorter time horizon to see payback from IT investments. In today’s economy with higher rates and limited top line visibility, technology vendors need to keep ROI and time to value top of mind. Vendors could consider employing the following strategies:

- Break apart solutions into modules with a smaller up front ticket size and a larger land / expand motion. Ensures customers can quickly see the benefit of their technology investment.

- Utilize ROI calculators to clearly demonstrate the lift and value delivered by the technology.

- Get buy-in not just from a champion but all customer employees who will use the software. 61% of contractors reported lack of employee acceptance as the top barrier to technology adoption6. Employee buy-in can be generated through easily accessible training and support.

The market for construction technology and collaboration tools is still in the early days of adoption. There are a set of adopters utilizing legacy incumbents and emerging vendors, but a significant portion of the construction industry still relies on manual workflows, paper-based processes, and spreadsheets. The opportunity for technology to combat inflation, increased data accessibility, and construction stakeholders who are more educated than ever on the benefits of technology, fosters an environment that is ripe for high ROI vendors. Sageview is speaking with construction tech vendors who have found product-market fit and we’re looking to help these businesses reach the next level.

Sources:

1Cemex Ventures, 2Pitchbook, 3Autodesk, 4Togal.AI, 5Procore, 6Builder Trend