Closing process Locked: Why we are excited to lead Closinglock’s Series B Funding

By: Roberto Avila, Eric Bockhaus, Margot Kleinman

The Sageview team is incredibly excited to lead Closinglock’s $34 million Series B funding round. Closinglock is at the forefront of innovation in the real estate industry as the leading fintech and fraud prevention provider. Founder and CEO, Andy White, used personal experience to identify the need in this market and has since done a tremendous job of building a purpose-built solution that is loved by Title & Escrow companies across the US. As the real estate markets continue to evolve technologically, we believe Closinglock is well-poised to further their critical role in protecting and streamlining real estate transactions for Title & Escrow companies, real estate agents and consumers alike. We are honored at the opportunity to support Closinglock’s journey; here are a few reasons we believe their future is extremely bright.

A sure-fire way to keep the Closing process Locked

In real estate, few events are as critical—or as stressful—as closing day. It’s the culmination of significant investments in time, money, and energy for everyone involved: buyers, sellers, lenders, brokers, and Title companies alike. However, an often-overlooked aspect of closing is the tremendous importance of security and efficiency in handling sensitive financial and personal data. If any part of the transaction is jeopardized—such as the wiring instructions, personal identification documents, or final settlement statements—the consequences can be devastating.

Instances of fraud in the real estate closing process have meaningfully risen in the last 5-10 years. Nearly 1 in 4 buyers report being targets of fraud at some point in the transaction process.1 Criminals often target the closing process by intercepting emails, falsifying wire instructions, or hacking into unsecured systems. Moreover, the insurgence of AI has only exacerbated these instances of fraud as AI-powered tools enable fraudsters to more easily and realistically perpetrate fraud. Unfortunately, even a small oversight in verifying the authenticity of wire instructions or identity can lead to significant financial losses for individuals and Title & Escrow companies. No matter how technologically adept an individual may be, everyone is vulnerable to cyberattacks during the real estate transaction process. 2

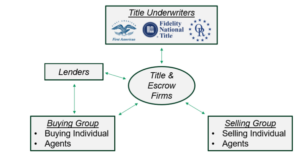

While individuals are often the public face of attempted fraud, Title & Escrow companies play a critical role in the real estate closing process, serving as the connective tissue between the buying group, selling group, Title underwriters, lenders and more. Title & Escrow officers create Title reports and in turn arrange for Title insurance, in addition to coordinating all document sharing and the movement of funds across parties throughout the transaction. Given the outsized role of Title & Escrow agents in the real estate transaction—and the over two trillion of transaction volume moving through this process—these transactions become a honeypot for fraudsters, underscoring the need to leverage sophisticated technology to protect all stakeholders.

A Needed Solution

Enter Closinglock, an Austin, Texas based platform with a suite of products that enables the safe and secure flow of funds during the complex real estate transaction process. By providing a centralized, secure, and user-friendly platform, Closinglock is upgrading how real estate closings happen for both agents and buyers/sellers, mitigating wire fraud risk and offering peace of mind for all parties involved.

Closinglock’s value proposition is simple: their platform helps mitigate the risk of wire fraud for all stakeholders by securing communication channels, encrypting sensitive data, and ensuring that only authorized individuals can access closing information. Beyond the important security functionality, Closinglock’s suite of products also provide a way to streamline and centralize the closing process so all parties can access necessary forms, instructions, and agreements from a single, secure portal.

Given the rampant nature of fraud across real estate closings today, Title & Escrow companies are motivated to protect sensitive information in any way possible. Any instance of fraud can lead to irreplaceable financial losses with Title & Escrow companies often on the hook for the dollars lost or otherwise reputationally ruined in their market. Closinglock’s platform provides these companies and agents peace of mind to continue operating despite the prevalence of fraud. While the platform has never been breached by a security threat in its history, for further protection, Closinglock has backstopped their platform with a $2.5m insurance policy per verified transaction to cover the possibility.

During our diligence, customers across the nation raved about the protection Closinglock provides them in addition to the time and money savings they achieve – earning rare stellar reviews in an industry rife with legacy technology. Closinglock has come onto the scene quickly, growing more than 20x in the last 3 years and protecting more than 1 million transactions across the country over the past 4 years.

The Payments and Expansion Opportunity

In addition to the strong value of Closinglock’s core product offerings, we see significant opportunity for Closinglock to expand their product offering across the transaction landscape. In 2023, Closinglock introduced a payments portal that allows customers to pay their good funds payments through Closinglock. This replaces the traditional, arcane approach of in-person wires at your local bank branch and is better understood by younger generations used to doing everything on their phones. Over $2 trillion dollars move in and out of escrow accounts annually, further underscoring the opportunity Closinglock has with its payments portal.

Given their importance to closing agents across the ecosystem, Closinglock is excited to continue expanding their platform to provide additional value and resources to their customers. With the expertise of the Closinglock team, we believe this will be a matter of “when” not “if.”

Team

Co-Founders Andy and Abby White originally experienced fraud in real estate from personal experience after Abby witnessed a buyer losing funds to a phishing email at her prior workplace. Andy was an engineer and builder by nature so they set out to solve this problem together, creating a suite of products that would ensure security for all stakeholders in the closing process. The two went full time with Closinglock in 2021 and have since built out their executive team to include Weston Conway and Sushma Zoellner, in addition to many other talented individuals. Weston (COO) was the first full time hire at the company and brought a bevy of expertise in GTM from his time at Procore. Sushma (CPO) joined the team in 2023 after successful stints at numerous companies in the Austin ecosystem including Bloomfire, RetailMeNot, and H.E.B.

The Road Ahead

In an industry built on trust amidst large financial transactions, the importance of a secure, streamlined closing process cannot be overstated. Whether you’re a buyer, seller, Title professional, attorney, or real estate agent, Closinglock offers a vital layer of protection against wire fraud while improving overall efficiency. When real estate professionals invest in Closinglock’s insurance-backed secure closing software, they demonstrate a commitment to safeguarding client assets and personal data. By centralizing document management, encrypting sensitive data, and implementing best-in-class verification, Closinglock ensures that closings are smooth, transparent, and safe for all involved.

Sources:

1. “Wire Fraud in Real Estate: Silicon Valley Executive Warning.” CNBC, 23 July 2024,

LINK: CNBC – Wire Fraud in Real Estate.

2. “Consumers: Agents Aren’t Warning Us Enough About Scams.” Realtor Magazine, National Association of REALTORS®, March 2024,

LINK: NAR Realtor Magazine