Founder-Investor Fit: Partnering for Long-Term Success

By Will Kunin

My introduction to growth equity came in the fall of 2020 through a Zoom screen from my kitchen table; not a unique experience for those that navigated the remote and hybrid work environment over the past 18 months. Discussions with coworkers, entrepreneurs, and management teams took place on an LED screen with investment decisions made as a team but in physical isolation. This separation alongside an ever-increasing fundraising environment where capital has been readily available has led to an unprecedented investing landscape.

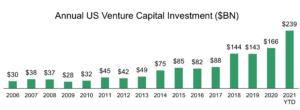

An obvious statement, to say the least, the size and speed of fundraising has accelerated over the past few years. In 2021 alone, startups raised $239 billion through September, surpassing the $166 billion raised in all of 2020. Investment decisions are now made faster than ever. I have seen data rooms open and almost instantaneously close, as a company receives a term sheet in days without any in-person interaction – not a unique experience for many in my seat.

The question that arises from these stats is: what is contributing to this accelerating investing speed?

- Dry Powder: there is more private capital available than ever. In the first nine months of 2021, VCs raised $96 billion across 526 funds. More than in any prior full year.

- Virtual Efficiencies: virtual fundraising discussions have become the norm. Founders and investors can quickly jump on a Zoom. The friction of traveling and aligning schedules is gone. Likewise, Investment Committees can be pulled together in moments and make investment decisions entirely virtually.

- Increased Opportunity Set: there are more high-quality companies than ever. Today there are ~240,000 privately held software companies in North America, and ~4,000 were created in the past year. A sizeable number of these companies are actionable for VCs, growth, and buyout investors, creating a robust opportunity set and an environment where no one wants to miss out on the next “big winner.”

- The Resiliency of Technology: investors and entrepreneurs alike have seen, firsthand, the strength and resiliency of technology during the pandemic. Technology adoption has skyrocketed as innovative companies have alleviated many of the problems exacerbated by the pandemic. As software continues to drive efficiencies and cement itself into workflows, it continues to attract investor attention.

While highly competitive for investors, this environment presents clear benefits to founders. Slow fundraising processes can be distracting to management teams who are trying to build their businesses. Currently, companies are inundated with capital partner options. Access to cash is being democratized, and companies no longer need to be in a specific location or know the right people to access funds and expertise. Today, investors come to founders in the form of emails, voicemails, and texts (apologies if you’ve been subject to one of my cold calls).

Although access to capital is seemingly abundant, a founder’s decision to partner with an outside party is personal. Choosing an investor is an irreversible decision, and, arguably, founder-investor fit can be as crucial to a business’s long-term success as product-market fit. When navigating stormy seas, it is less critical who paid for the boat and more important to trust who is in the boat with you.

At Sageview, we know that a company’s journey will not always be “up and to the right.” We partner with management teams we know we can stand by through the twists and turns. Relationships aren’t instantly formed over two Zoom calls but instead fostered through a mix of remote and in-person interactions. Although we are minority investors (most of the time), we always take a lead investor mindset with board representation. We run a concentrated portfolio, so we have ample time to work with each company on operational initiatives. We bring to bear all our resources to ensure each company is as successful as possible. The conviction in our deep partnership approach is backed by the fact that 20%+ of Sageview’s investable capital comes from our team members.

When evaluating opportunities, we focus on having multiple conversations with management teams and meet in person when we can. For example, as the Sageview team worked through due diligence on our investment in Carewell, we were afforded multiple remote discussions and an outdoor in-person meeting with the co-founders. Meeting the team face-to-face was not only a refreshing change from the Zoom screen but allowed us to build deeper trust between both parties.

Relationships are core to Sageview’s business. We are investing out of a $710 million fund and invest in only 12-18 companies per fund. This concentrated portfolio ensures that we can provide each of our companies the attention they deserve. Today, our team is on Zoom and out on the road meeting with founders and our current partners. We believe the relationships we are forming are more crucial than ever and are the foundations of enduring businesses.